The Toronto Regional Real Estate Board (TRREB) has released its housing figures for August. With 4,975 transactions reported through the local MLS, home sales were down 5.3% when compared to the same time last year.

With the rate of new listings outpacing sales, the market remains well-supplied at the start of September. The 12,547 new listings represent a 1.5% increase over last August, with active listings rising 46.2% year-over-year to 22,653. Housing inventory now sits at 4.6 months.

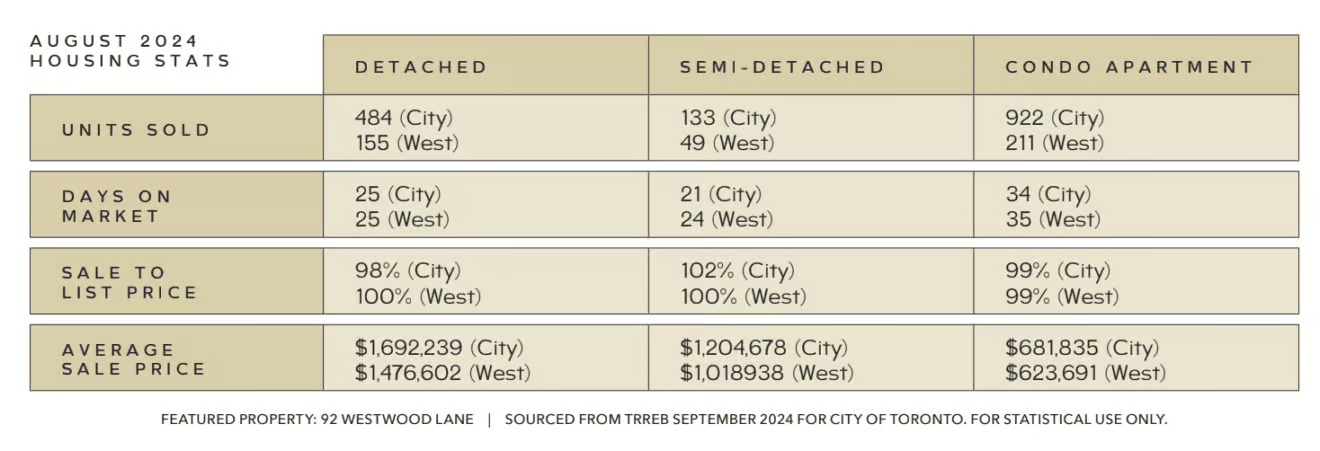

The rise in housing inventory worked to push prices down slightly from a year ago. The average selling price of $1,074,425 represents a modest 0.8% decrease from 2023. The MLS Home Price Index (HPI) Composite Benchmark, which serves as a measure of inflation in the market, was down 4.6% year-over-year (-4.3% in Toronto).

Looking to optimize the sale of your Toronto home? Explore these blog posts for strategic insights.

- Strategic Pricing When Selling Your Home

- Is an Accelerated Home Sale Possible in Today’s Market?

- How Agent Performance Impacts Sellers in a Challenging Market

The average August sale took place in 28 days on market at 99% of the listing price, with 70.13% of all transactions sitting between $600,000 and $1,500,000. Sales of homes over $2,000,000 accounted for 5.99% of the sales mix, down from 6.53% in August. Detached homes represented 44.6% of total sales, followed by condo apartments at 28.5%.

Looking at prices by housing type: Detached homes sold for an average of $1,414,070, representing a 0.3% decrease from last August, and a month-over-month decrease of 0.8%. The average price for semi-detached homes was $1,026,435 (-3.9%/-3.9%), townhomes sold on average for $891,892 (-4.6%/-2.5%), and the average price of condos was $674,706 (-4.5%/-6.1%).

As we enter the fall market, buyers continue to benefit from increased housing supply and relief in selling prices, most notably in condominium apartments and ground level attached homes. Following this week’s third consecutive interest rate reduction by the Bank of Canada, and with the anticipation of more cuts to come, expect affordability to improve, especially for those using variable rate mortgages. As sales pick up, ample choice in the market should work to keep price growth moderate.

If you are planning to buy or sell real estate, please speak with our team. We are here to help you stay informed and up to date. Christensen Real Estate Group has been in business for over four decades and we offer a wealth of experience in all market cycles.

For over 40 years, our clients have trusted us to minimize risk, offer unbiased opinions, and ensure their best interests are served. Contact us today to talk about your needs. Email us at info@christensengroup.ca or call 416-722-4723.