Toronto Sees Sales Surge Amid Improved Affordability

The Toronto Regional Real Estate Board (TRREB) has released its housing data for July 2025. As leading West Toronto real estate professionals, we’re here to help you decipher it. With improved affordability, the Greater Toronto Area (GTA) experienced the best home sales result for the month of July since 2021.

A total of 6,100 sales were reported through the MLS system, representing a 10.9% increase over the same time last year. New listings rose 5.7% to 17,613, while active listings climbed 26.2% year-over-year to 30,215. This pushed inventory levels to 4.95 months, giving buyers more time, more options, and greater negotiating power.

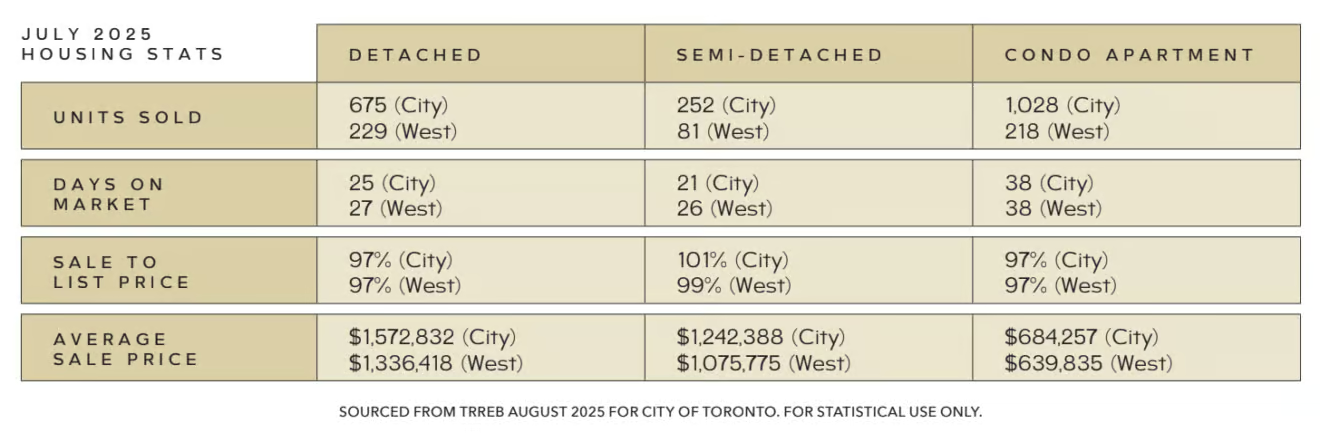

The average selling price in the GTA declined to $1,051,719, down 5.5% year-over-year and 4.5% from June. The MLS Home Price Index (HPI) Composite Benchmark fell 5.44% across the GTA, and 4.20% in the City of Toronto. Homes are taking longer to sell, with an average of 30 days on market, and are selling for 98% of their list price. Most of the sales activity—just under 70%—occurred in the $600,000 to $1.5 million range, while only 5.8% of sales topped the $2 million mark.

Preparing to sell your Toronto home? Explore these related blogs.

- Should You Sell or Lease Your Condo

- Will I Pay Capital Gains Tax on My Home?

- Downsizing in a Toronto Buyer’s Market? Here’s How Your Home Can Earn You More Money

Detached homes continue to lead the way, accounting for 45.8% of all transactions. Condo apartments made up 25.8% of sales, followed by townhomes (freehold and condo combined) at 17.2%, and semi-detached properties at 9.8%.

Here’s the average price breakdown by property type:

• Detached: $1,361,660 (↓5.1% Year over Year / ↓2.2% Month over Month)

• Semi-detached: $1,041,359 (↓2.3% YoY / ↓4.4% MoM)

• Townhomes: $849,380 (↓7.4% YoY / ↓2.6% MoM)

• Condo apartments: $651,483 (↓9.3% YoY / ↓6.5% MoM)

While affordability is gradually improving, it’s worth noting that much of that progress is coming in the form of price reductions (as illustrated in the chart above), rather than borrowing costs. The Bank of Canada recently held its key lending rate steady at 2.75% for the third consecutive announcement, offering limited relief to those facing mortgage renewals.

For over 40 years, our clients have trusted us to minimize risk, offer unbiased opinions, and ensure their best interests are served. Contact us today to talk about your needs. Email us at info@christensengroup.ca or call 416-722-4723.