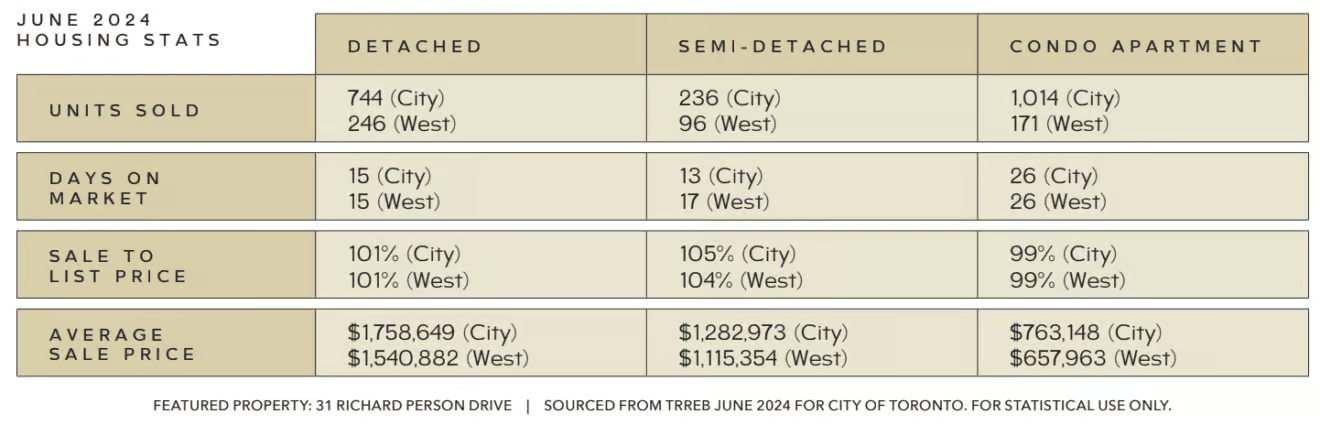

The Toronto Regional Real Estate Board (TRREB) has released its housing figures for June. With 6,213 home sales reported through the local MLS, transactions were down 16.4% compared to the same time last year. This marks a fourth consecutive month of cooling activity, despite the Bank of Canada’s recent interest rate cut.

New listings and inventory continue to rise, offering greater selection and negotiating power to buyers. The 17,964 new listings are a 12.3% increase over last June, with active listings rising 67.4% year-over-year to 23,613. Housing inventory now sits at 3.8 months.

The rise in inventory worked to push prices down from last year. The average selling price of $1,162,167 represents a 1.6% decrease from 2023. The MLS Home Price Index (HPI) Composite Benchmark, which serves as a measure of inflation in the market, was down 4.6% year-over-year (-4.34% in Toronto).

Looking to optimize the sale of your Toronto home? Explore these blog posts for strategic insights.

- Why Staging is Important in a Balanced Market

- How Selling Luxury Properties Differs From Standard Listings

- Pricing Your Home Strategically

The average June sale took place in 20 days on market at 100% of the listing price with 70.42% of all transactions sitting between $600,000 and $1,500,000. Sales of homes over $2,000,000 accounted for 8.14% of the sales mix, down slightly from 8.46% in May.

Looking at prices by housing type: detached homes sold for an average of $1,480,399, representing a 3.3% decrease from last June, and a month-over-month decrease of 1.75%. The average price for semi-detached homes was $1,102,904 (-9.3%/-6.1%), townhomes sold on average for $931,490 (-4.9%/-1.7%), and the average price of condos was $727,861 (-1.5%/-0.04%).

As we enter the summer months, many buyers continue to keep their home purchasing decisions on hold in anticipation of additional rate relief. Certainly, the Bank of Canada’s rate cut last month provided some initial support, however June sales figures suggest that most buyers want multiple rate cuts before moving off the sidelines. Moving forward, as sales activity accelerates alongside lower borrowing costs, elevated inventory levels should help protect against a quick rise in selling prices.

If you are planning to buy or sell real estate, please speak with our team. We are here to help you stay informed.

For over 40 years, our clients have trusted us to minimize risk, offer unbiased opinions, and ensure their best interests are served. Contact us today to talk about your needs. Email us at info@christensengroup.ca or call 416-722-4723.