The Toronto Regional Real Estate Board (TRREB) has released the housing data for February. With 4,037 transactions reported through the local MLS, sales were down 27.4% from the same period last year. Extreme weather events challenged buyers, while uncertainty surrounding U.S. trade added another layer of complexity which impacted market activity.

With the rate of new listings continuing to outpace sales, the market remains well-supplied heading into March. The 12,066 new listings represent a year-over-year increase of 5.4%, with active listings rising 76.0% to 19,536. Housing inventory now sits at 4.8 months.

With the increase in inventory, average prices came down slightly. The average selling price of $1,084,547 represents a 2.2% decrease from February 2024. The MLS Home Price Index (HPI) Composite Benchmark was down 1.77% year-over-year (-0.81% in Toronto).

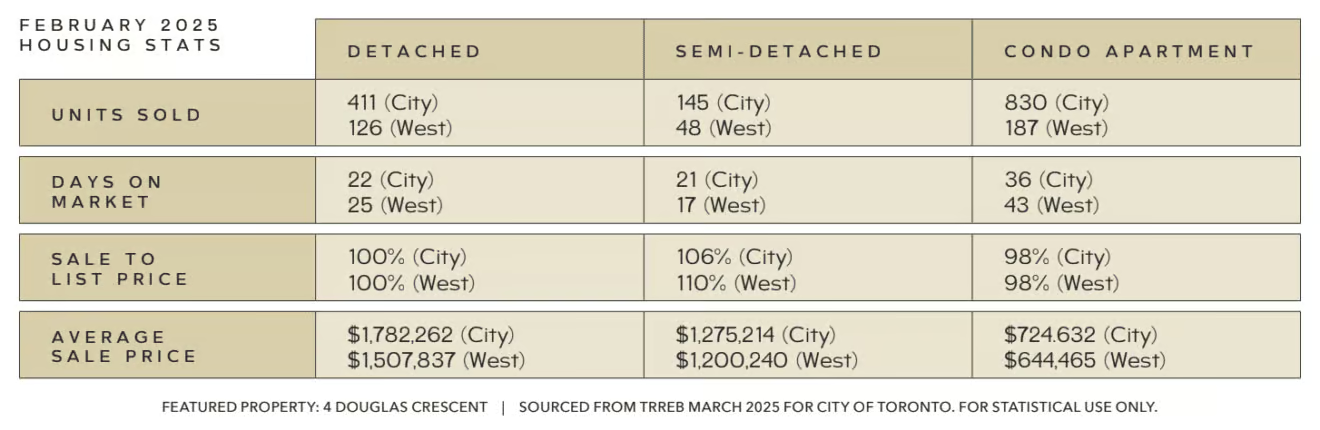

The average February sale took place in 28 days on market at 99% of the listing price, with 69.8% of transactions falling between $600,000 and $1,500,000. Sales of homes over $2,000,000 were up 6.2%, an increase of 4.9% in January. Detached homes represented 42.3% of total sales, followed by condo apartments at 30.2%.

Looking to optimize the sale of your Toronto home? Explore these blog posts for strategic insights.

- How to Sell Without Losing Money

- Why Staging is Important in a Balanced Market

- Pricing Your Home Strategically

Looking at prices by housing type: detached homes sold for an average of $1,445,879, representing a 0.2% increase from a year earlier and a month-over-month increase of 5.0%. The average price for semi-detached homes was $1,079,996 (-4.0% /+3.1%), townhomes sold on average for $911,483 (-2.3% /+0.7%), and the average price of condos was $688,055 (-1.3% /+2.6%).

As we enter March, it’s clear that these are unique times. Following last month’s provincial election, the Liberal leadership race is now nearing a conclusion, setting the stage for a federal election. At the same time, the U.S. has initiated a trade war with Canada, adding a layer of economic uncertainty that may affect demand and borrowing costs. While rising housing supply and anticipated interest rate cuts are expected to improve affordability, market conditions will depend on how these broader economic and political shifts unfold.

If real estate is on your mind—whether you’re buying, selling, or simply looking for meaningful insight—speak with a member of the Christensen Real Estate Group. We’re here to provide clarity on the current market and answer your questions.

For over 40 years, our clients have trusted us to minimize risk, offer unbiased opinions, and ensure their best interests are served. Contact us today to talk about your needs. Email us at info@christensengroup.ca or call 416-722-4723.