The Toronto Regional Real Estate Board (TRREB) has published the sales figures for April. With 7,114 home sales reported through the local MLS, transactions were down 5.0% compared to the previous year. This marks a second straight month of cooling activity following a strong start to 2024.

A surge of new homes for sale in April offered prospective buyers increased choice as they navigate the market. The 16,941 new listings are a 47.2% increase over last April, with active listings rising 74.4% to 18,088. Inventory now sits at 2.54 months.

The rise in listings worked to keep prices relatively unchanged from a year earlier. The average selling price of $1,156,167 represents a 0.3% increase from 2023 and a 3.0% increase from March. The MLS Home Price Index (HPI) Composite Benchmark, which helps measure inflation in the market, was down 0.97% year-over-year (-1.23% in Toronto).

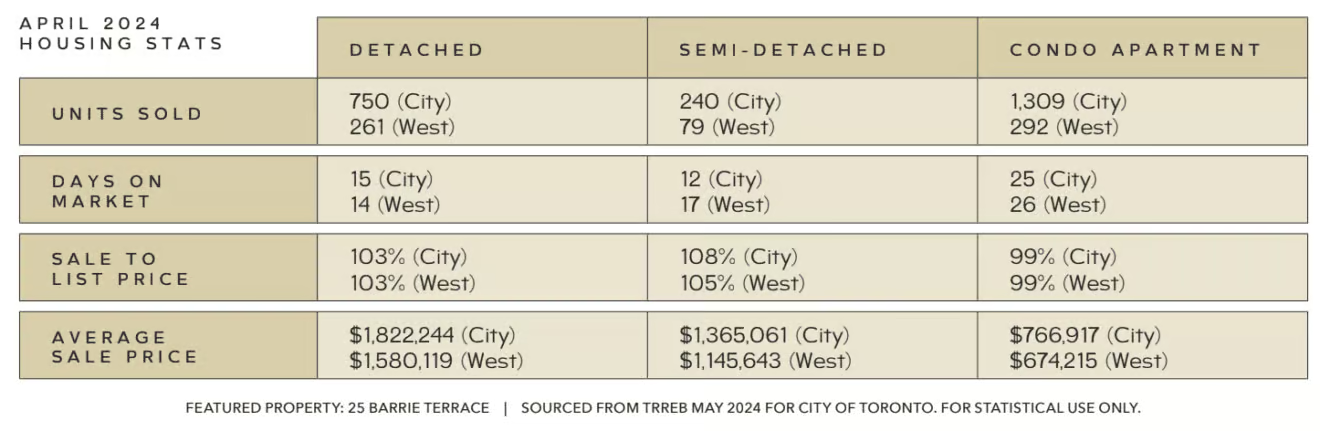

The average sale took place in 19 days on market at 102% of the listing price, with 70.26% of all transactions sitting between $600,000 and $1,500,000. Sales of homes over $2,000,000 accounted for 7.93% of the sales mix. This was up from 6.86% in March, suggesting an increased appetite for higher priced homes.

Looking to optimize the sale of your Toronto home? Explore these blog posts for strategic insights.

- Strategic Pricing When Selling Your Home

- How Agent Performance Impacts Sellers in a Challenging Market

- An Essential Guide to Property Values

Turning to prices by housing type: detached homes sold for an average of $1,516,070, representing a 1.8% increase from last April and a month-over-month increase of 3.4%. The average price for semi-detached homes was $1,139,929 (+0.3% /+1.6%), townhomes sold on average for $949,839 (-3.7%/+1.0%), and the average price of condos was $728,067 (+0.6% /+4.0%).

With the spring market now well under way, buyers are benefitting from increased choice in the marketplace. For the time being, however, the rise in listings is not translating to lower prices, with homeowners holding firm in anticipation of lower borrowing costs. In the months ahead, it is expected that lower lending rates will support tighter market conditions, resulting in reduced supply and renewed price growth.

If you are planning to buy or sell real estate, please speak with our team. We are here to help you stay informed and up to date. Christensen Real Estate Group has been in business for over four decades, and we bring a wealth of experience to changing markets.

For over 40 years, our clients have trusted us to minimize risk, offer unbiased opinions, and ensure their best interests are served. Contact us today to talk about your needs. Email us at info@christensengroup.ca or call 416-722-4723.